When Bitcoin launched in 2009, it traded for less than a cent. Many doubted it could ever trade above $1, let alone climb above $120,000 as it has today. Years later, the same disbelief surrounds meme tokens. Dogecoin was laughed at until it rallied more than 200,000% and nearly touched $1 in 2021. Now Shiba Inu (SHIB) faces the same question: could it ever make the jump from fractions of a cent to a full dollar?

How Dogecoin’s 246,500% Rally Stopped Short of $1

Dogecoin was introduced in 2013 with no maximum supply. Roughly 5 billion new DOGE enter circulation each year, making it inflationary. For years, DOGE traded for fractions of a cent and was used mainly for tipping and microtransactions.

In 2014, DOGE’s price hovered around $0.0003. By May 2021, during the meme-stock and crypto frenzy, it hit an all-time high of $0.73. That was a 246,500% increase, fueled largely by social media campaigns, celebrity endorsements — most notably by Elon Musk — and retail access through apps like Robinhood.

However, Dogecoin never crossed $1. Its inflationary supply diluted gains, and as hype cooled, its price fell. Today, DOGE trades far below its peak with a market cap of about $39.6 billion. The lesson is clear: community energy can drive enormous gains, but tokenomics eventually impose limits.

For SHIB to Hit $1, its Value Must Exceed the U.S. Economy 20x

Shiba Inu (SHIB) launched in 2020 on Ethereum with a different model. Unlike Dogecoin, it has a maximum supply, but that supply is massive: nearly 589 trillion tokens. At today’s price of $0.000013, SHIB’s market capitalization is about $7.6 billion, with daily trading volume near $233 million.

For SHIB price to reach $1, its value would need to increase 76,923 times, or 7,692,300%. That would create a market cap of about $590 trillion. To understand how big that is: the United States GDP is about US$30.5 trillion in 2025. China’s and the European Union’s economies are similarly in the tens of trillions. So SHIB at $1 would have to represent a market value about 20 times the size of the United States economy, or many times the size of the entire global crypto market, which is at US$4 trillion now. That contextualizes how far SHIB would need to travel.

At $1, SHIB alone would be worth 20 times the U.S. economy and hundreds of times larger than Bitcoin itself. No asset in history has ever reached such scale, which shows the mathematical impossibility of $1 under current supply conditions.

Shiba Inu price hit its all-time high of $0.00009 in October 2021. The surge was fueled by multiple factors: Binance and Coinbase listings, widespread retail speculation, and spillover enthusiasm from Dogecoin’s rally earlier that year. Burn narratives also played a role in drawing attention.

However, like Dogecoin, SHIB’s rally was speculative. Once hype faded, price collapsed. The peak demonstrated when SHIB adoption is strongest: during retail-driven bull runs.

1.3M Holders, Shibarium Growth — But Adoption Still Trails Ethereum and Solana

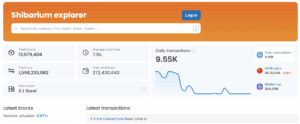

Supporters argue that SHIB is more than a meme coin. ShibaSwap, its decentralized exchange, allows trading and staking. Shibarium, a layer-2 blockchain, processes hundreds of thousands of transactions daily at lower cost than Ethereum. The project has also introduced NFTs and companion tokens like BONE and LEASH.

On-chain data shows more than 1.3 million SHIB wallet holders. Daily trading volume exceeds $200 million, ensuring liquidity. However, adoption is still modest compared to major blockchains like Ethereum or Solana. Developers have yet to build applications at the same scale. Ownership remains concentrated, with around 70% of SHIB held by a small group of wallets. This concentration increases volatility and highlights how dependent SHIB remains on a narrow base of large holders.

The SHIB Burn Program: How and Why it Falls Short

To tackle its massive supply, the SHIB community has embraced token burning. Burns occur through the Shibburn portal, ecosystem apps, and even community projects that redirect ad revenue into permanent destruction of tokens. Billions of SHIB are burned each year, removed forever from circulation.

However, against nearly 589 trillion tokens, the burns barely make a dent. At the current pace, supply reduction is too slow to change fundamentals. Analysts estimate that more than 99% of tokens would need to be destroyed before SHIB could approach one cent. This explains why, even with creative burn mechanisms, the math for $1 doesn’t work.

Meme coins thrive on novelty, creating another obstacle for SHIB. In the last two years, tokens like PEPE, FLOKI, and BONK have captured trader attention. Speculators often rotate between meme coins seeking quick gains, meaning dominance is rarely permanent.

This rotation shows why SHIB’s demand is fragile. Its 2021 rally depended on peak meme culture, but sustaining that level of attention in future cycles is uncertain. At the same time, regulators are increasingly examining speculative tokens. Any restrictions on meme trading could reduce liquidity, adding another headwind.