Wisconsin lawmakers introduced Assembly Bill 471 (AB 471) on Monday. The bill seeks to exempt crypto activities from money transmitter licenses. It focuses on mining, staking, software development, and digital asset exchanges without legal-tender conversion.

According to the Wisconsin Legislative Reference Bureau, the draft clarifies when a Department of Financial Institutions (DFI) license is not required. The text defines activities that remain outside money transmission. It draws a bright line at conversion to legal tender or bank deposits.

The proposal presents narrow categories to reduce ambiguity. It covers crypto mining and staking as protocol activities. It also addresses exchanging digital assets when no fiat is involved.

Money Transmitter Licenses and Crypto Mining: What AB 471 Changes

AB 471 states that mining does not require a money transmitter license. The same applies to staking on a blockchain protocol. The language applies to individuals and businesses in Wisconsin.

The bill also covers software development on a blockchain protocol. Builders working on wallets or tools would operate without money transmission rules. The focus remains on technical participation rather than fiat movement.

It further addresses exchanging digital assets when trades stay crypto-to-crypto. Because no legal-tender conversion occurs, the activity avoids licensing. This boundary guides compliance for local users and firms.

Self-Hosted Wallets and Digital Assets Payments: Statutory Protections in Wisconsin

AB 471 limits what governments inside the state can restrict. It says neither a state agency nor a political subdivision may block accepting digital assets as payment for legal goods and services. It also protects self-hosted and hardware wallets.

The document states:

“Under the bill, neither a state agency nor a political subdivision may prohibit or restrict a person in accepting digital assets as a method of payment… or in taking custody of digital assets using a self-hosted wallet or hardware wallet.”

The text sets clear protections in statute. The coverage is direct and specific.

Additionally, the bill lists four protected actions. A person may operate a node, develop software, transfer digital assets, and participate in staking. Each action connects to blockchain protocol use rather than fiat transmission.

Blockchain Development and Nodes: Wisconsin Crypto Rights Under AB 471

The bill clarifies that people may operate a node to connect to a blockchain protocol. This permits participation in network operations. It supports validators and node runners with explicit coverage.

It also protects software development across blockchain protocols. Teams can write and deploy code without triggering money transmission obligations. The framing keeps technical work distinct from financial services.

Finally, AB 471 covers transferring digital assets and staking under the same umbrella. These activities remain lawful without a DFI license. The categories help users interpret their rights with simple terms.

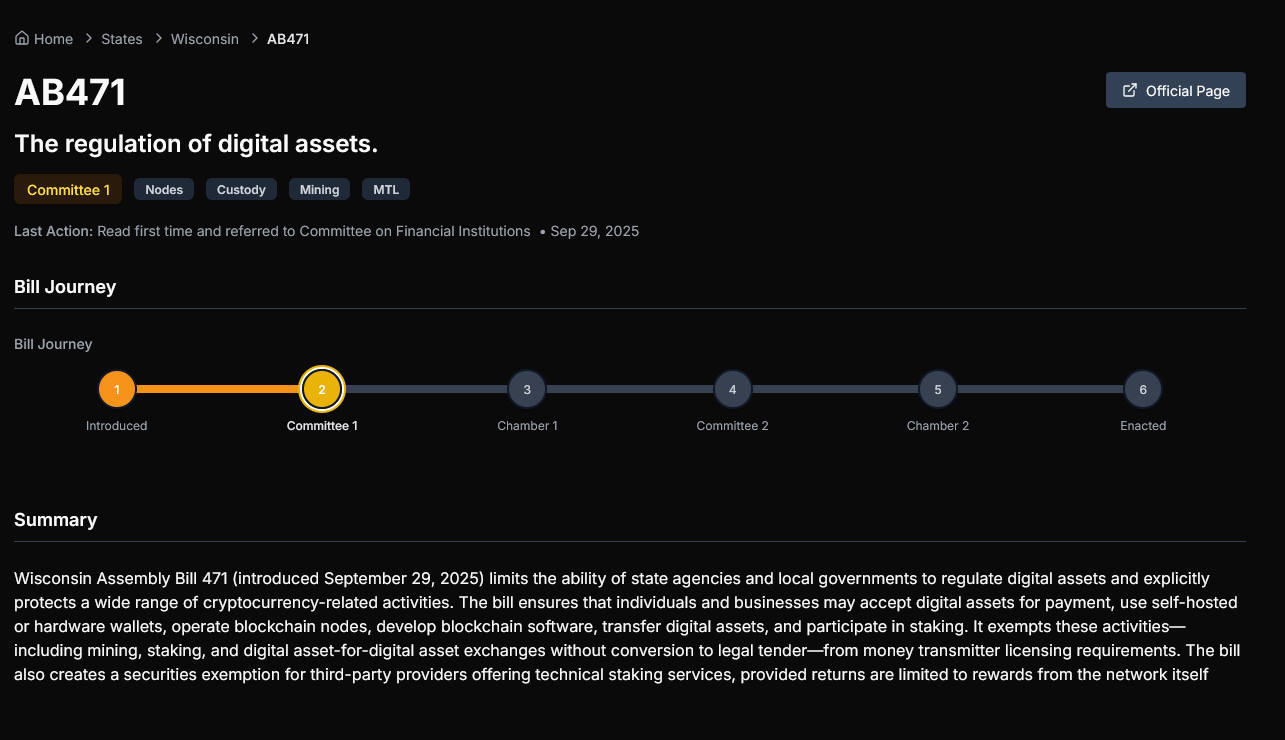

The bill lists seven Republican sponsors in the Assembly. It also includes two Republican co-sponsors in the Senate. The bill has been referred to the Committee on Financial Institutions.

According to LegiScan, AB 471 shows a 25% progression rate. It still must pass one chamber and two more committees. These steps include hearings and scheduled votes.

Each checkpoint sets the near-term path for Wisconsin crypto policy. The committee calendar will shape the next movement. The document’s scope will remain central in testimony and analysis.

Crypto Exchanges Without Legal-Tender Conversion: Money Transmitter License Clarity

AB 471’s core boundary is conversion to legal tender or bank deposits. When a digital assets exchange involves fiat, licensing may still apply. When trades remain crypto-to-crypto, licensing is not required.

This clarity affects Wisconsin crypto exchanges and market makers. It helps them structure flows around digital assets rather than cash rails. It also guides compliance teams on when to seek DFI approval.

Moreover, the bill’s language aids retail users. They can understand the difference between crypto protocol activity and money transmission. The simple standard lowers confusion in day-to-day activity.

Digital Assets Payments and Self-Custody: Wisconsin Crypto Use Cases in Plain Terms

The bill protects merchants who accept digital assets for legal goods and services. It bars government restrictions on that practice. It anchors everyday payments in state law.

The bill also protects self-custody through self-hosted and hardware wallets. Users can take custody of digital assets on their own terms. The statute names these wallets directly.

The language keeps the focus on routine activity. It supports Wisconsin crypto use without broad claims. It uses direct terms that reduce room for confusion.