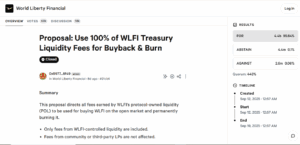

The World Liberty Financial (WLFI) buyback and burn proposal ended today on Sept.19 with 99.85% of votes cast in favor. The measure commits the protocol to using all fees generated from its own liquidity pools to repurchase WLFI tokens from the market and permanently remove them from circulation.

The plan applies to protocol-owned liquidity (POL) — trading pools on Ethereum, BNB Chain, and Solana that are controlled directly by World Liberty Financial. Whenever trades occur in these pools, fees are generated. Under the new framework, those fees will no longer remain idle in treasury accounts. Instead, they will be used continuously to buy WLFI tokens on the open market and send them to a burn address, effectively destroying them.

Importantly, the program excludes fees generated by liquidity supplied by community members or third-party providers. Only the portion of trading activity tied to WLFI’s own liquidity reserves will feed the buyback and burn cycle.

The vote closed with 4.4 billion votes in favor, 2.6 million against, and 4.4 million abstaining.

This is not the first time WLFI governance has produced near-unanimous results. In July, a vote to allow WLFI tokens to become tradable passed with more than 99% support.

WLFI’s governance practices have not been free from controversy. Earlier this month, the project froze wallets belonging to several large holders, including accounts linked to prominent investor Justin Sun, citing violations of lock-up rules. While supporters argued this protected the community from opportunistic selling, critics warned it highlighted the protocol’s centralized control over token movements.

Continuous WLFI Buybacks Aim to Counter 100B Token Supply

WLFI has a total supply of 100 billion tokens. At launch on Sept. 1, around 24.6 billion tokens were unlocked for trading. The remaining supply is locked under vesting schedules for early investors, team members, advisors, and founders.

Early backers were granted 20% of their allocations at launch, with the remaining 80% subject to governance-controlled unlocks. The community has significant influence over when and how these tokens will be released, but the scale of future unlocks — more than 70 billion tokens — represents a critical risk to price stability.

Earlier this month, WLFI burned 47 million tokens from unlocked reserves, worth about $11 million at the time. While symbolically important, that event reduced circulating supply by less than 0.2%.

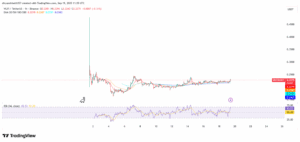

Since its debut, WLFI price has faced sharp volatility. The token launched near $0.47, fell to lows around $0.16, and has since stabilized in the $0.20–$0.22 range. Market capitalization is currently estimated at $5 billion, with daily trading volumes often exceeding $400 million.

Burn Program Faces Limits From Unlocks, Fee Dependency and Governance Risk

The success of the burn program depends on several interlocking factors. If trading activity in WLFI’s liquidity pools remains high, the program could steadily reduce supply and help stabilize price. If volume falls, the deflationary effect will be weak.

The larger risk remains supply pressure from WLFI token unlocks. Even an aggressive burn strategy may not compensate for billions of new tokens entering the market if early investors or insiders choose to sell.

There is also the issue of resource allocation. Redirecting 100% of POL fees to burns may leave the project underfunded for development, security, and ecosystem expansion. Unless WLFI identifies alternative revenue sources, this trade-off could slow long-term growth.

Finally, the combination of governance centralization and political association adds uncertainty. Decisions such as wallet freezes, coupled with potential regulatory action, mean that WLFI’s tokenomics cannot be viewed in isolation from external factors.