World Liberty Financial moved on several fronts today. A live governance proposal would direct all protocol owned liquidity fees to permanent buybacks and burns. The project continued token unlocks through its Lockbox flow. It also expanded its USD1 stablecoin activity on Solana with partners BONK.fun and Raydium. Separately, scrutiny lingered over last week’s wallet blacklists that included Justin Sun.

Governance vote targets 100 percent of liquidity fees

WLFI’s governance portal shows an active measure titled “Use 100 percent of WLFI Treasury Liquidity Fees for Buyback and Burn.” The tally indicates strong approval while the vote remains open. Community posts describe the plan as redirecting protocol owned liquidity fees to on chain repurchases that are subsequently burned.

Coverage over the weekend echoed the high approval readings. Third party write ups placed support near ninety nine percent, with finalization expected later this week. The proposal’s mechanics focus on fee capture rather than new issuance changes.

WLFI made the token tradable earlier this month after a holder vote in July authorized secondary market activity. The tradability shift explains why governance around liquidity fees now carries operational weight for the treasury.

Operations advance across unlocks and Solana stablecoin

Unlocks proceeded through the Lockbox contract on the official site. The workflow requires wallet connection, activation, and an agreement before claims. WLFI’s guide notes that balances may show inside the contract during the process and that claiming opened from September 1. The team highlighted the feature on X as part of its launch sequence.

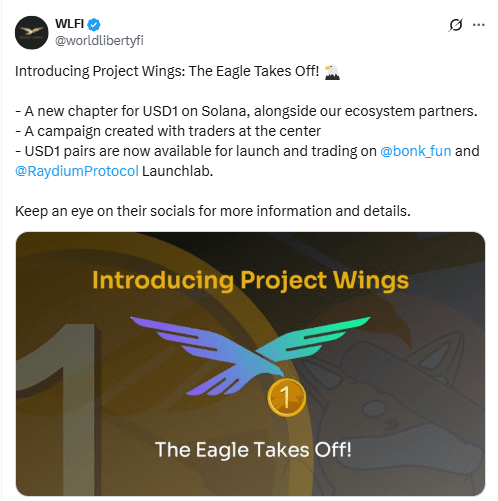

Meanwhile, WLFI pushed USD1 onto Solana venues under a program branded Project Wings. BONK.fun and Raydium said creators can now launch and trade USD1 pairs through their platforms. The initiative went live last week and aims to deepen USD1 liquidity and tooling on Solana.

Industry trackers also flagged a related campaign that rewards activity in the stablecoin’s pairs. Announcements referenced coordination among WLFI, Raydium, and BONK.fun. Timelines placed the rollout around September 11.

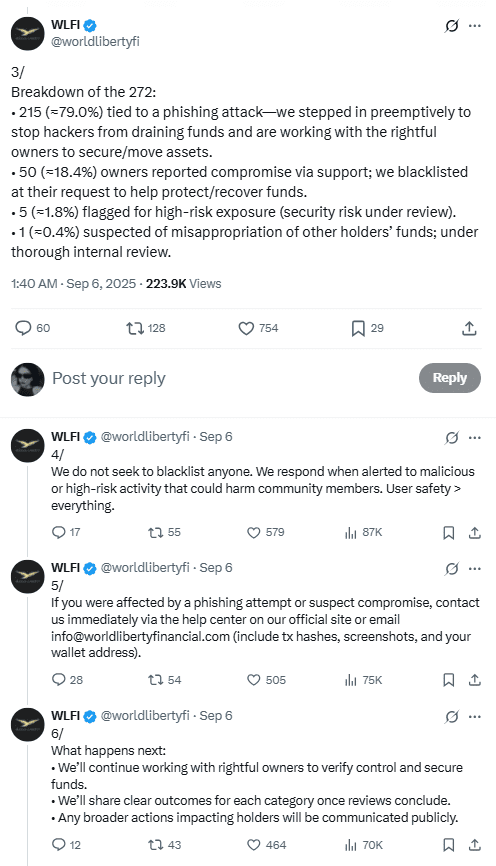

Blacklist fallout persists after high profile freeze

WLFI confirmed it blacklisted hundreds of wallets following launch. External reporting counted 272 addresses on the list, citing compromised keys and phishing among the reasons. The action sparked debate about enforcement transparency and on chain governance scope.

One listed wallet belonged to Justin Sun, who said his presale allocation was frozen and urged an unlock. Reuters reported that Sun claimed at least seventy five million dollars invested in WLFI, while the project said sales by early investors faced set limits. The team did not answer Reuters’ inquiries.

The freeze followed WLFI’s first trading day in early September. That context ties the blacklist episode to launch controls and unlock policies that remain in force through the Lockbox.

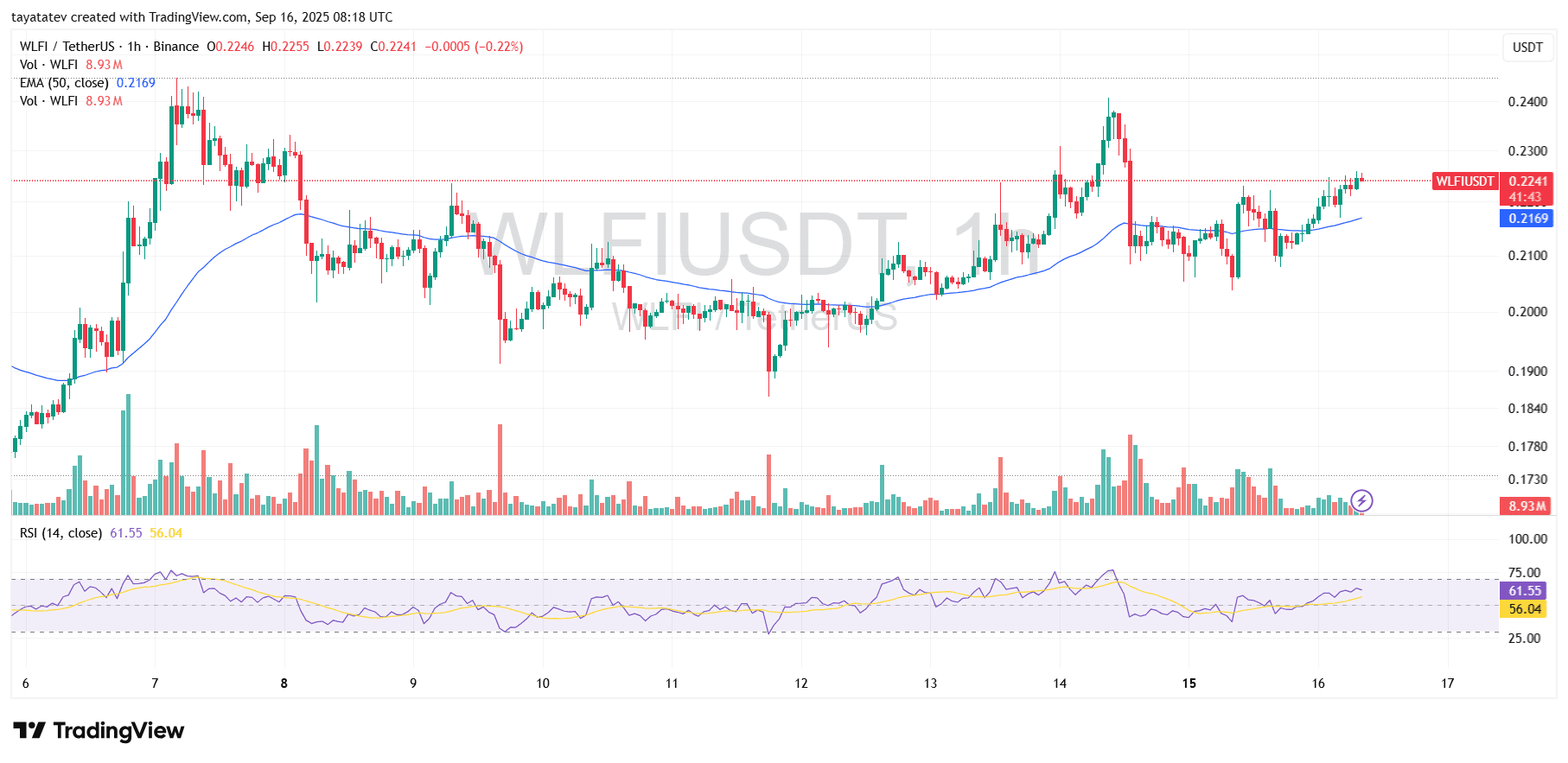

WLFI intraday on September 16, 2025

The one hour WLFI USDT chart on Binance carries a TradingView timestamp of September 16, 2025. Price trades near 0.224 at the last candle, while the 50 period EMA sits around 0.2169. RSI reads about 61.6, which signals firm but not overbought momentum. Volume shows 8.93 million on the panel at the right edge.

From September 6 through September 14, price whipsawed between sharp spikes near 0.245 and pullbacks that tested the low 0.20 area. After a fast dip around September 12, buyers stepped back in and pushed candles back above the 50 EMA. Since then, the chart has printed higher lows and a steady grind higher, which keeps intraday structure tilted upward.

Into today, price holds above the rising 50 EMA and presses the 0.230 area that capped several prior attempts. The 0.230 to 0.233 band acts as the first resistance, followed by the recent swing high near 0.245. On the downside, the EMA zone near 0.216 and the round 0.210 level define the nearest supports. RSI near 60 supports continued strength, yet it leaves room before the usual overbought band. Volume remains lighter than the September 14 burst, so a decisive break will likely need a pickup in activity.

In short, the session shows WLFI firming above its trend guide and approaching resistance. If candles hold above the 50 EMA, the chart keeps a constructive bias toward the 0.230 handle and the 0.245 swing high. If not, traders will watch how bulls react around 0.216 to 0.210 as the first defense.

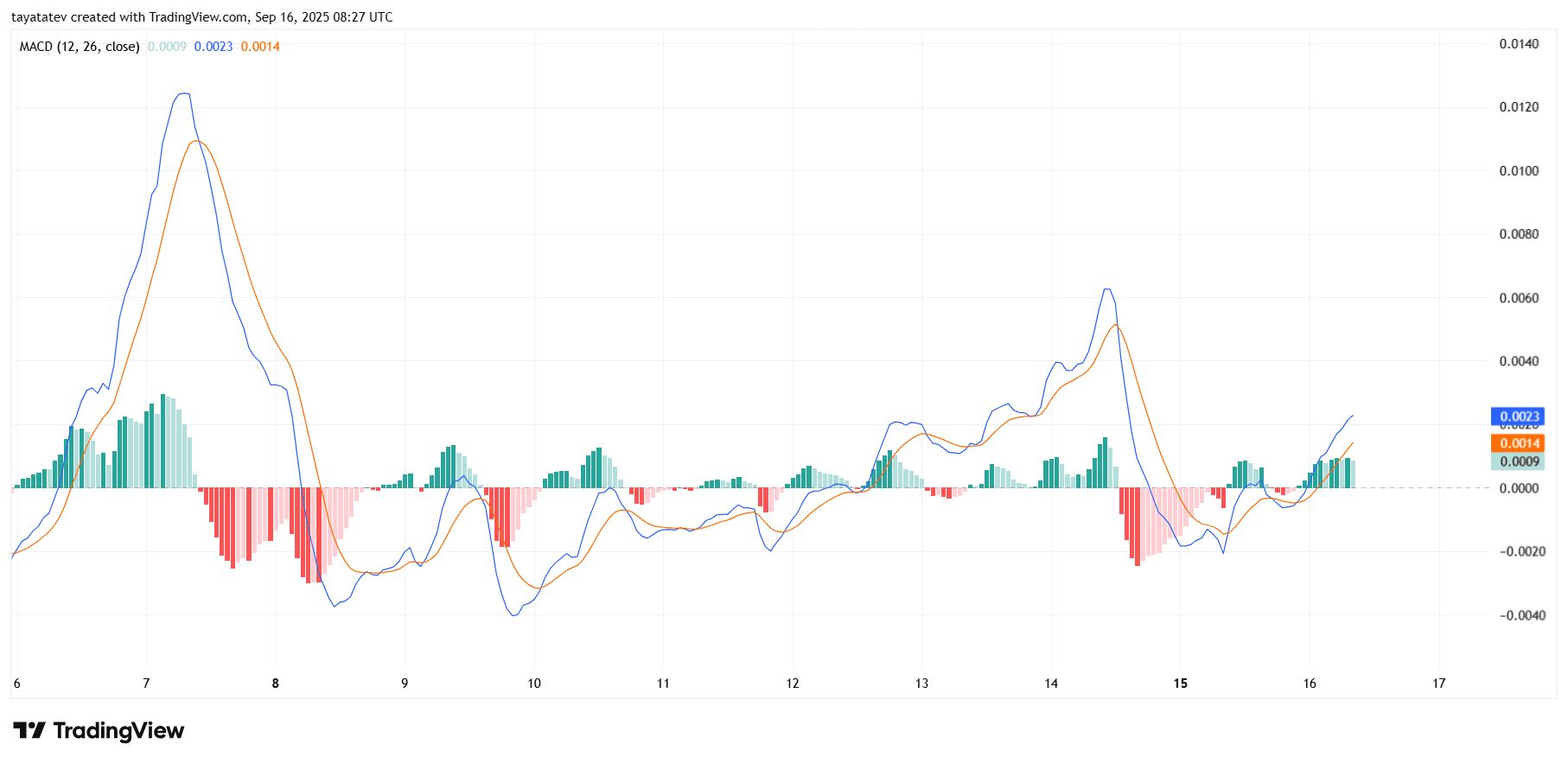

WLFI 1h MACD on September 16, 2025

The MACD (12,26, close) readings show the MACD line near 0.0023, the signal line around 0.0014, and a positive histogram near 0.0009. Therefore, the MACD sits above the signal and prints green bars, which confirms a fresh bullish crossover a few candles earlier.

Through the past week, momentum cycled sharply. A strong upswing peaked around September 7, then flipped negative into September 8–10. Short, shallow positive pulses followed on September 9–12 before a larger surge on September 14. That burst quickly reversed on September 15 as the histogram turned deep red and the MACD slipped beneath the signal. However, momentum based back up late on September 15, and by early September 16 the blue MACD reclaimed the orange signal, taking the histogram back above zero.

Now, the slope of both lines tilts upward and the green histogram bars expand gradually, indicating strengthening intraday momentum. Yet the MACD hovers close to the zero line, so the current impulse remains early and sensitive to shifts in flow. If the histogram continues to build while the MACD holds above the signal, upside momentum broadens. If the lines flatten or cross down again, the rebound loses steam.