Canary filed an updated S 1 for its spot XRP exchange traded fund and removed the “delaying amendment” that had kept the product waiting at the U.S. Securities and Exchange Commission. With that clause gone, the issuer can let the registration go effective on its own timeline, not the SEC’s.

The filing says the XRP ETF can list on Nov 13, 2025 if Nasdaq signs off on the separate Form 8 A listing application. That exchange approval is now the key step before trading starts.

Canary also confirmed it already has XRP trading counterparties in place, naming Flowdesk, Cumberland DRW, FalconX and Virtu to supply liquidity once the fund begins creations and redemptions. That setup mirrors what the firm did for its Solana, Litecoin and Hedera products earlier this month.

Today’s move matters because other XRP ETF applicants are still in the SEC queue. Canary is the first to flip its filing into “ready to go” mode under the new spot crypto ETF standards the SEC adopted in September. If Nasdaq clears the listing on time, this will be the first U.S. spot XRP ETF on the market.

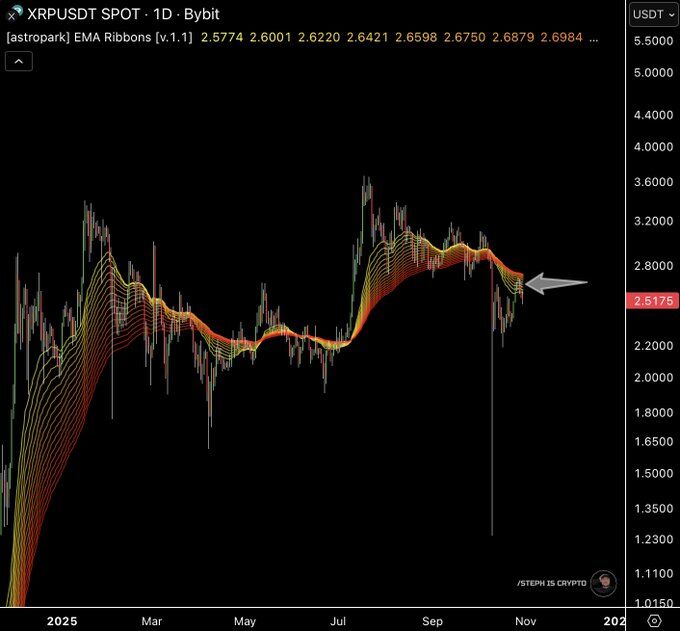

XRP Faces Daily EMA Ribbon Rejection

XRP tested the EMA ribbon cluster on the daily chart and failed to break through it. The rejection came near the 2.57–2.70 USDT zone on Bybit, where several short term moving averages overlapped and formed a compressed resistance band. Price tried to push into that band after the sharp recovery from the long lower wick, but sellers defended the area and forced XRP back below the ribbons. The move confirms that this zone still acts as dynamic resistance, not support.

The chart shows why this area matters. Earlier in July and again in September, XRP traded above the same ribbon stack and used it as a launchpad for the advance toward the 3.20 USDT region. Now the structure is flipped. The ribbons turned down, spread out, and started leaning over price, which usually means momentum is with the downside until candles close above the entire cluster. As long as XRP stays under the ribbons, every retest can attract profit taking and fresh shorts from traders who watch moving average confluence.

However, the rejection does not cancel the recovery attempt. Price still holds above the post spike low and continues to print higher intraday troughs after the long flush wick. That tells us buyers are present, but they need a clean daily close above the top of the ribbon to reclaim control. Until that happens, the ribbon zone around 2.60–2.75 USDT remains the key ceiling for XRP, and the market trades inside a corrective phase rather than a confirmed trend resumption.

XRP Holds Key 2.55 Zone While Monthly Close Looms

XRP ended the last daily session in bearish mode, but the chart still shows a clear line that matters. CRYPTOWZRD said price must stay above 2.5500 USDT to keep the structure in bullish territory; slipping back under that level would turn the market sideways again and slow momentum. The signal is simple: above 2.55, buyers can press; below 2.55, XRP likely ranges.

The analyst also pointed to the calendar. The upcoming monthly close will decide how strong this recovery phase looks on higher timeframes. If XRP closes the month near or above that short term support, the candle will confirm demand stepped in after the recent pullback. If it closes under it, the market will need more consolidation before the next move. Because Bitcoin often drives intraday sentiment, the update noted that BTC price action will shape XRP’s next push and traders should track the lower timeframes while BTC sets direction.

On the intraday view, the post highlighted a descending structure that keeps capping XRP rallies. Price is pressing against that trendline, but not breaking it yet, so sellers still control the top of the range. A decisive break above the line, while holding 2.55 as a floor, would flip the picture back to a cleaner bullish setup. Until that happens, traders should expect more back and forth inside the band the chart shows.