XRP ETFs have failed to regain momentum amid prolonged crypto market volatility, consistently recording little-to-no capital intake in recent days.

Following slow performances seen across all XRP funds, the U.S. spot XRP ETFs have logged another day of net outflows for the fifth time since they launched in November 2025.

XRP ETFs record lowest outflow ever

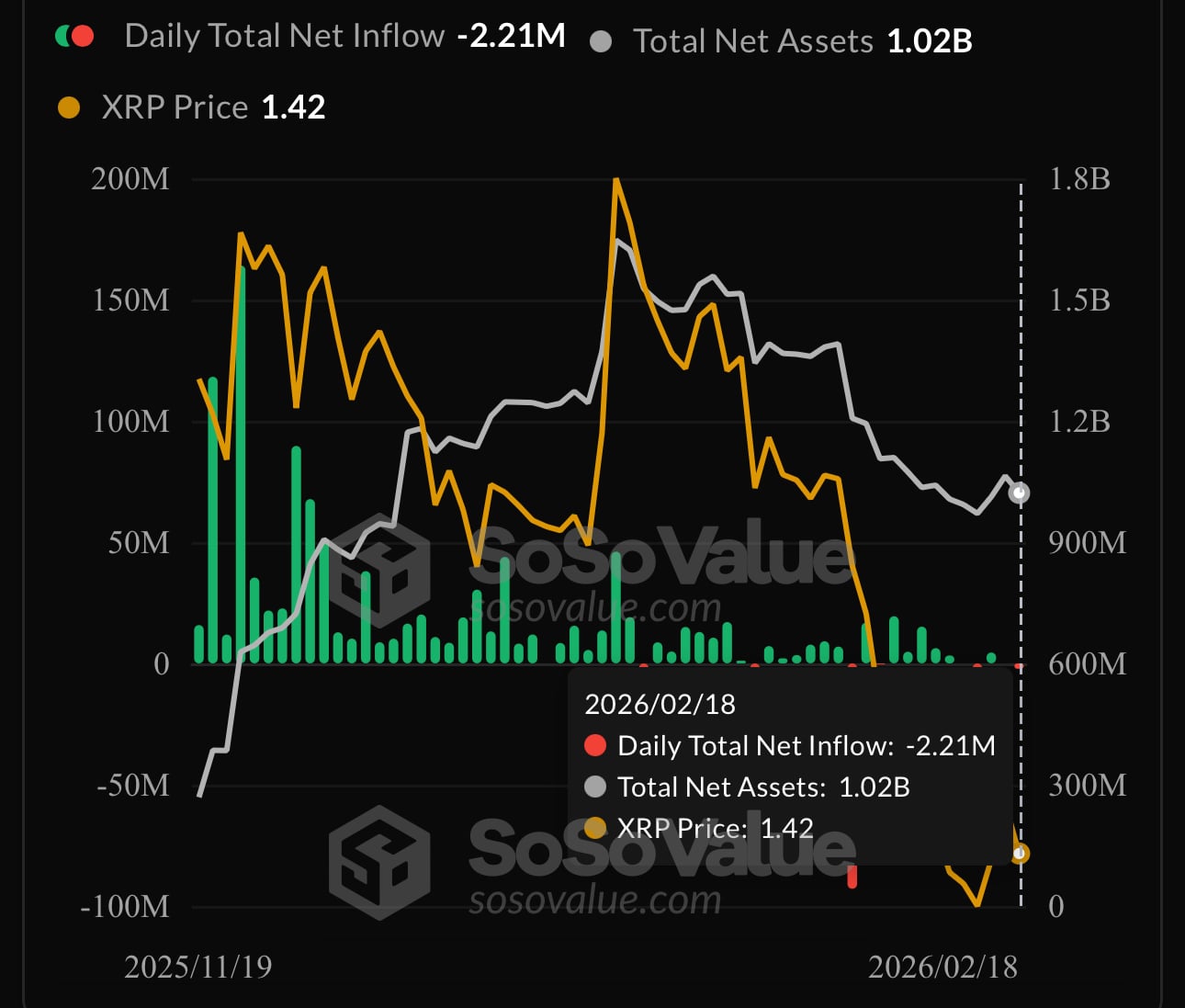

According to data from SosoValue, the poor performance seen during the last trading session saw XRP ETFs record a total net outflow of $2.21 million as of Feb. 18.

Notably, this marks the fifth and lowest capital withdrawal ever recorded by the XRP funds. This suggests that institutional investors are yet to regain their confidence in the future outlook of these funds, as the broad market sell-off continues to intensify.

Although XRP ETFs have seen larger amount of capital exit their funds in the past, this withdrawal has caught the attention of market participants as it positions the price of XRP for more downward pressure despite recent recovery attempts.

XRP dips 5%

As usual, the poor performances seen across the XRP funds appear to have been triggered by increased selling pressure faced by XRP and other leading cryptocurrencies.

Amid the prolonged volatility, XRP has continued to show weak price movements, and the asset has plunged by 5.28% over the last day, trading at $1.39 as of writing time.

While all XRP funds saw zero activity except for Grayscale — which single-handedly incurred the $2.21 million withdrawal recorded during the last 24-hour trading period — it appears that institutional investors are taking caution as XRP continues to fail every attempt to break past $1.70 and reclaim its position around $2.00.