The XRP Ledger’s native token, XRP, saw its price recover on Sept. 24 toward the $2.88 region after recent volatility really shook the broader crypto market. The token defended critical support zones even as social media posts debated whether momentum could extend higher.

Furthermore, on-chain data showed heavy holder activity around $2.80, while analysts shared patterns highlighting $2.71 as another key level. At the same time, Ripple secured attention through partnerships involving BlackRock, VanEck, and DBS. Analysts outlined bullish scenarios but stressed that losing $2.70 would expose further downside risks.

Analysts Emphasize Critical Levels for XRP

After XRP’s recent defense of the $2.80 region, analysts focused squarely on whether the token could sustain momentum or risk deeper losses.

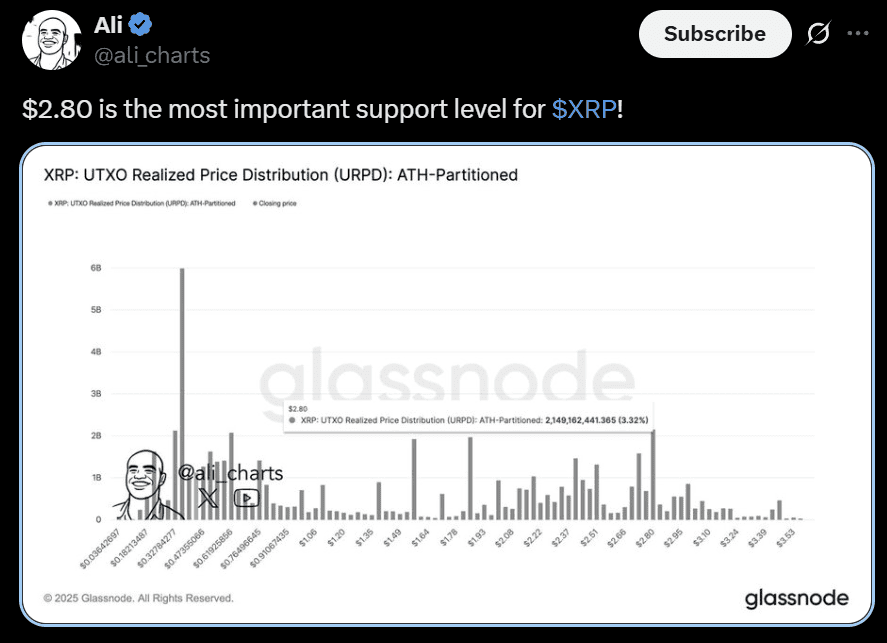

Independent market analyst Ali highlighted the $2.80 zone as the most crucial support based on on-chain distribution data, where over 2.1 billion tokens had last moved, equal to 3.32% of supply. The analyst stressed that holding this level kept bulls in control, while a breakdown could add pressure from large holders turning unprofitable.

Moreover, Ali pointed to $2.71 as another crucial threshold in a separate chart review. He argued that defending this zone could set the stage for a rebound toward $3.20, with extended targets around $3.60, provided buying activity remained steady.

Analyst CasiTrades examined the same area through an Elliott Wave framework. She noted that the XRP USD pair formed a double bottom near $2.70–$2.79, which aligned with a valid Wave 2 structure. Price had recovered above the 0.5 Fibonacci retracement at $2.79, suggesting that the trend remained constructive. She explained that another retest of $2.79 was likely before XRP attempted a Wave 3 advance, as bullish divergence appeared on the four-hour RSI.

CasiTrades’ analysis underlined that a decisive break below $2.70 would invalidate the structure and shift focus to the 0.618 retracement near $2.58. This is a level that could act as the final line of defense before sharper losses.

Analysts Agree on Battleground Zone

Both analysts agreed that the $2.70–$2.80 zone marked the decisive battleground for XRP’s next move. On-chain positioning, Fibonacci retracements, and historical price reactions reinforced the importance of this band. Moreover, Ripple advancing its reach could also help the XRP token’s price action. This was in addition to the hype surrounding the token’s recently launched ETF.

Ripple’s Institutional Push Gains Traction

While analysts concentrated on technical levels, X-based independent market commentator Stellar Rippler outlined a series of developments reinforcing Ripple’s growing role in tokenized finance.

The firm expanded its institutional reach through partnerships that positioned the XRP Ledger as a platform for tokenized assets. BlackRock’s BUIDL Fund, which tokenized U.S. Treasuries, began operating on Ripple rails through Securitize and RLUSD. The move allowed instant bond settlement. This made it accessible around the clock, and signaled practical testing of Ripple’s infrastructure by the world’s largest asset manager.

VanEck followed with its VBILL Fund. This is another tokenized Treasury product routed through the same channels. BUIDL and VBILL underlined that tokenized fixed-income instruments were beginning to move across Ripple’s network. Market observers stressed that this development mattered less for immediate price action and more for establishing infrastructure carrying large volumes of traditional assets.

Ripple also secured backing from DBS, Singapore’s biggest bank, and Franklin Templeton. The collaboration focused on launching repo markets and money market funds on XRPL, with RLUSD serving as the settlement medium. These offerings aimed to replicate core financial plumbing on-chain, including overnight liquidity, collateralized credit, and institutional yield strategies.

The partnerships underscored Ripple’s attempt to move beyond retail-driven speculation and anchor XRP Ledger in traditional financial markets. These integrations marked a shift toward use cases that connected crypto infrastructure with established capital flows. In turn, they provided a backdrop for analysts’ focus on whether the XRP price could sustain above critical support and convert institutional progress into lasting confidence