- XRP price faces risk of continued correction as traders witnessed renewed selling pressure at $1.56 resistance.

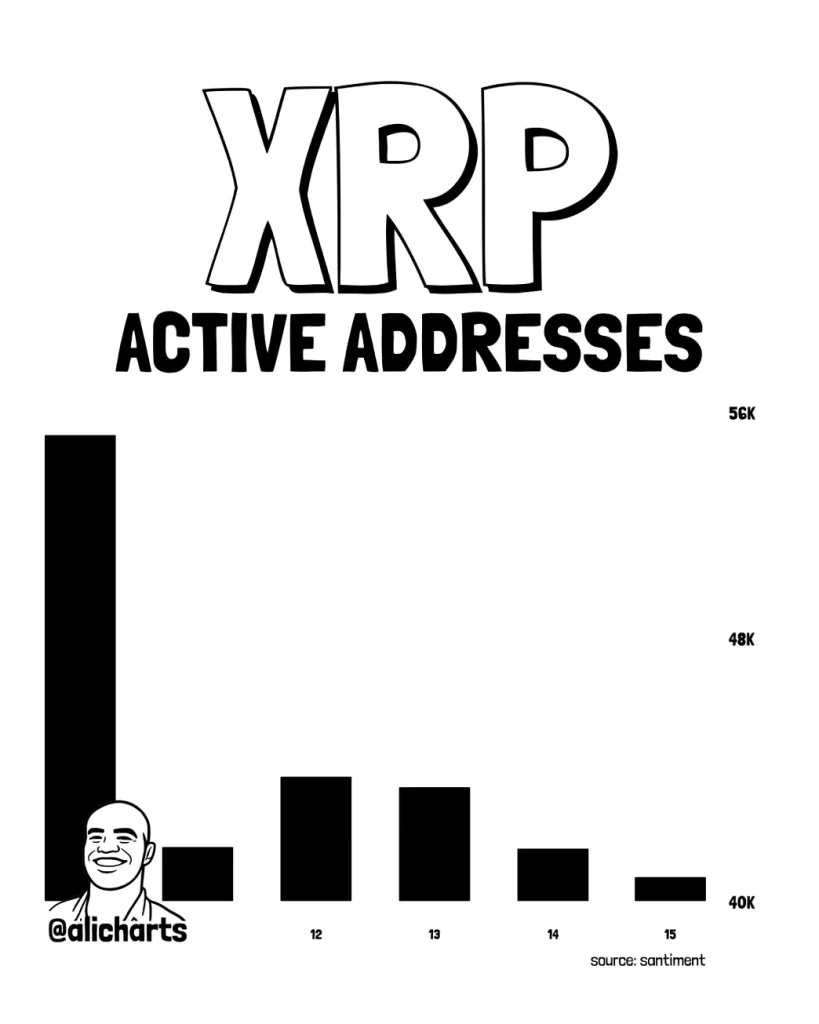

- Crypto analyst highlights a 26% decrease in XRP’s active addresses dropped from 55,080 to 40,778 amid current market uncertainty.

- The 41% reduction in open interest tied to XRP’s futures contracts indicates significant deleveraging among market participants

On Tuesday, the XRP price experienced a slight dip of over 0.88% to reach its current exchange hands at $1.47. The selling pressure can be attributed to general market weakness as Bitcoin struggles to hold the $70,000 mark or XRP facing overhead supply at $1.56. Along with price correction, the future contract tied to XRP and active addresses witnessed a notable retracement, reinforcing the risk of prolonged correction in price.

XRP Rally Faces Questions Amid Declining User Activity

XRP, the native cryptocurrency of the XRP ledger, witnessed a notable recovery from its early February low of $1.118 to current trading value of $1.47, registering a gain of 31.75%. Consequently, XRP’s market cap jumped to $89.93 billion.

This upswing outperformed the top two crypto currencies Bitcoin and Ethereum, which mainly traded in a sideways trend. However, the price action lacked support from on-chain activity as the number of active addresses witnessed a sharp drop.

In a recent tweet market analyst, Ali Martinez highlighted that the active addresses on XRP witnessed a sharp drop from 55,080 to 40,778, registering a loss of 26%. A reduction in active addresses often reflects lower transaction demand and reduced organic adoption, which can undermine the sustainability of bullish momentum.

In addition, the open interest tied to XRP’s futures contracts witnessed a significant increase for over a month. According to Coinglass data, the XRP OI has plunged from $4.51 billion to current value of $2.65 billion, accounting for 41.2% loss.

While the initial drop in this metric can be attributed to cascading liquidation of long-positioned traders, the ongoing downslope suggests that the market participants are still reducing their leveraged exposure from futures market to withstand ongoing price volatility.

If the downtrend in participation persists in derivatives and on-chain, XRP could face difficulty maintaining its upward momentum.

XRP Price Challenges Key Resistance at $1.56

A broader analysis of XRP’s daily chart shows that the recent price rebound emerged from the bottom trendline of falling channel pattern. Since July 2025, the coin price has been actively resonating within two parallel-walking trendlines that offer dynamic resistance and support to traders.

In a mid-way within this pattern, the XRP price faces overhead supply at $1.56 resistance. A long-wick candle rejecting from this barrier and 20-day exponential moving average adding additional resistance to the same suggest a risk of renewed correction.

If the overhead selling pressure persists, the XRP price could plunge 30% again and retest the bottom trendline at $1 psychological level.

On the contrary, if the buyer breaks above the $1.56 resistance, this remittance token would jump 22% to challenge channel resistance at $1.9.

A bullish breakout from this barrier will offer buyers an opportunity to replenish bullish momentum for a sustainable recovery above $2.

Also Read: Italy’s Intesa Sanpaolo Bank Discloses $96M Bitcoin ETF Holdings