Ripple delivered two non-price developments today: a $200,000 security “Attackathon” for the XRP Ledger (XRPL) Lending Protocol and a new institutional-custody partnership with South Africa’s Absa Bank. Separately, CEO Brad Garlinghouse pressed in Washington for fair access to Federal Reserve master accounts for crypto firms.

XRPL Lending Protocol enters public Attackathon

Ripple and Immunefi launched a targeted bug-hunting program to stress-test the upcoming XRPL Lending Protocol. The flat $200,000 pool unlocks if researchers land a valid exploit; otherwise, a fallback pool pays vetted insights. The event focuses on uncollateralized, fixed-term credit that settles on-ledger.

The Attackathon runs after a short education phase that opened this week. Immunefi’s schedule sets the education window in mid-October and the main competition from Oct. 27 to late November. Participants get protocol docs and direct Q&A access before live testing begins.

Organizers say pre-launch adversarial testing reduces production risk for a credit primitive that plugs TradFi underwriting into XRPL settlement. The format concentrates reviewers on core design and implementation, not market outcomes. Ripple framed the exercise as part of its security standard for protocol releases.

Absa adds Ripple custody in South Africa

Ripple confirmed that Absa will deploy its institutional custody stack to safeguard crypto and tokenized assets for clients in South Africa. The move broadens Ripple’s geographic coverage and brings a large African bank into its custody network. Today’s coverage highlighted the partnership’s role in regulated digital-asset infrastructure.

According to Ripple’s announcement, the collaboration expands the firm’s global custody footprint to Africa. Absa’s adoption targets institutional safekeeping and operational controls rather than trading features. The bank joins other regulated partners that use Ripple’s custody technology for client assets.

Media reports today emphasized enterprise demand and compliance as the drivers. They also noted that the arrangement focuses on service delivery and controls, not token prices. The timing follows regional interest in secure, bank-grade storage for tokenized instruments.

Policy push: master-account access

In separate remarks near Washington, Garlinghouse argued that qualified crypto firms should access Federal Reserve master accounts. He said parity with traditional institutions supports safety and market integrity, and he tied the point to Ripple’s U.S. banking ambitions.

The stance aligns with Ripple’s previously disclosed pursuit of a federal charter and the associated account. He cast access as infrastructure, not a special favor.

The comments arrive as policymakers weigh how bank-like crypto entities should connect to core rails. Any decision would affect custodians, payment platforms, and tokenized-asset venues built for institutions. For Ripple, the outcome shapes its U.S. operating model more than near-term market moves.

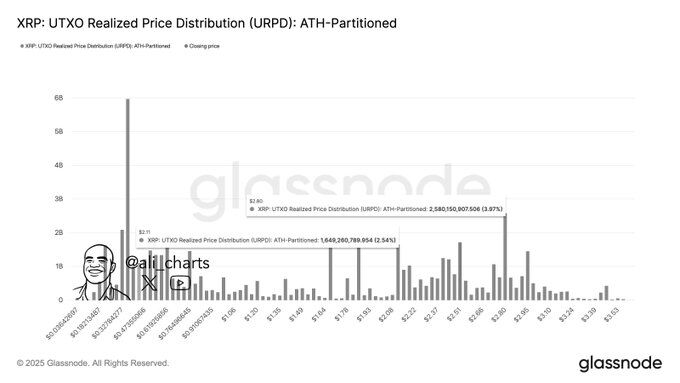

XRP Realized Price Clusters Highlight $2.80 Resistance and $2.10 Support

Glassnode’s latest XRP UTXO Realized Price Distribution (URPD) chart partitions historical cost bases around key price levels. The data reveals a dense cluster at $2.80, forming a major resistance zone, and another large base near $2.10, acting as structural support.

The $2.80 level corresponds to one of the largest historical realized-volume bars since the all-time high period. A significant number of addresses transacted at this level, creating overhead supply pressure when price approaches it again. This concentration often signals potential distribution behavior, as previous holders look to exit at breakeven.

In contrast, the $2.10 zone shows a thick support band. Many market participants built positions there, forming a structural floor in realized cost terms. When price approaches this area, the distribution suggests strong holding behavior and accumulation, which can absorb sell-side pressure. The two levels now frame the key range traders are monitoring for structural shifts in XRP’s realized cost basis.

XRP/ETH Pair Approaches Apex of Falling Wedge Pattern

XRP’s performance against Ethereum is nearing a critical technical point as the pair trades inside a large falling wedge on the daily chart. The structure has narrowed since February, with price repeatedly testing the converging support and resistance trendlines. The squeeze signals that a decisive move is approaching.

The falling wedge began forming in early spring, after XRP/ETH peaked and reversed. Since then, the pair has posted lower highs and lower lows, compressing toward the wedge’s apex. The current level around 0.0006067 ETH sits just above long-term support, while resistance caps any upside attempts from the descending upper trendline.

Falling wedges often resolve upward once price breaks through resistance with volume. In this case, a clean breakout would signal relative strength shifting toward XRP after months of underperformance. Traders are watching this structure closely, as a move outside the wedge would likely define XRP’s relative momentum against Ethereum in the coming weeks.

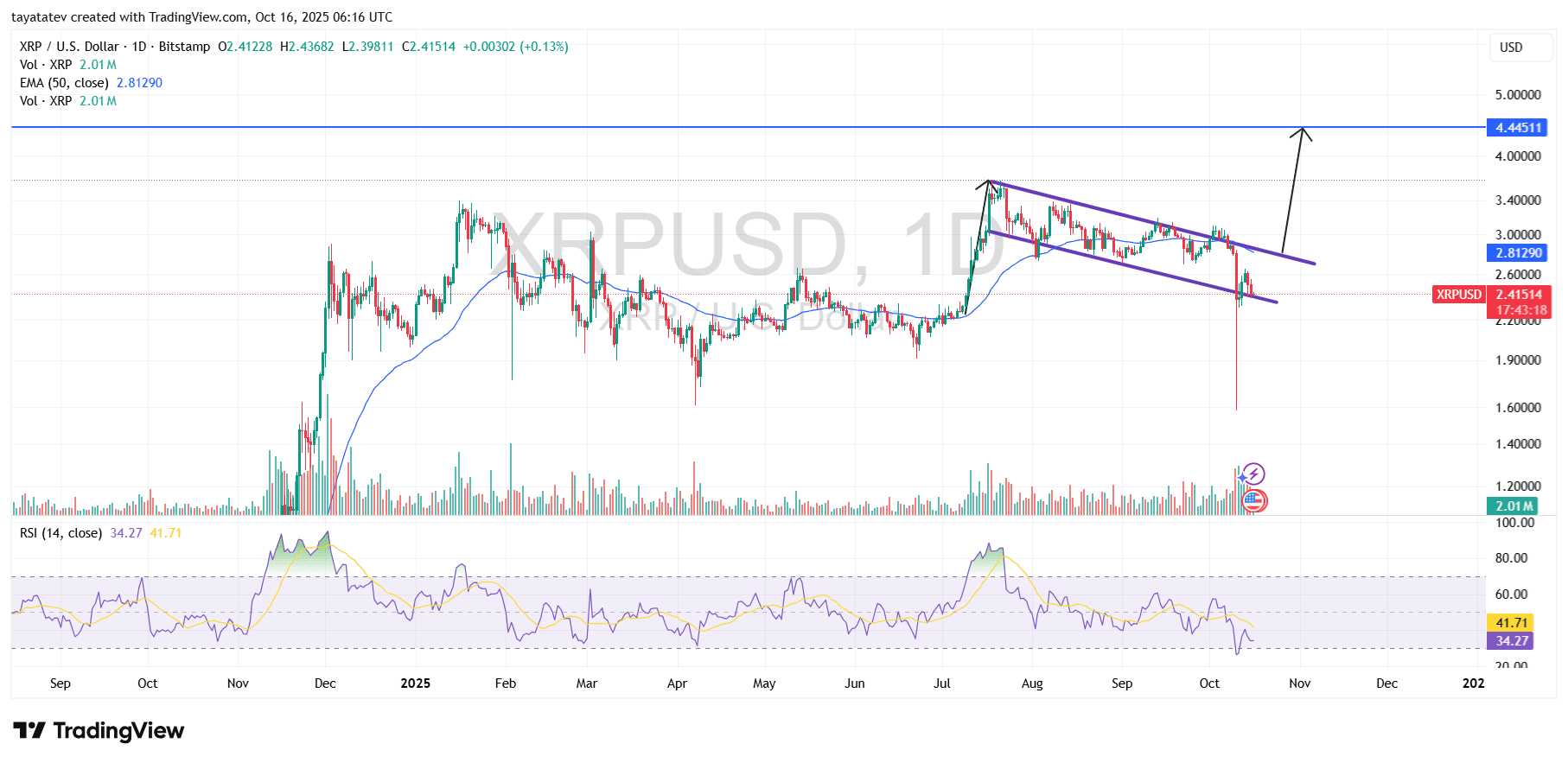

XRP forms bullish flag on Oct 16, 2025

On Oct 16, 2025, the XRP USD daily chart on Bitstamp shows a clear bullish flag after August’s sharp upswing, with price last at 2.415 and the flag sloping downward inside parallel lines. Volume cooled during the consolidation, and the 50 day EMA sits above at 2.813, framing the breakout area. Consequently, the pattern now approaches decision time as price grinds toward the upper boundary.

A bullish flag is a continuation setup where a strong rally (the pole) pauses inside a downward sloping channel (the flag) before trend often resumes higher. Therefore, traders usually look for a decisive daily close above the flag’s upper trendline—ideally with rising volume—to confirm the pattern. Such confirmation would signal that the prior impulse remains in control.

If the breakout confirms, the measured objective implies about 84 percent upside from the current price, which projects to ~4.44. In turn, that aligns with the chart’s marked resistance band near 4.445, offering a clean reference for target setting and risk management as momentum returns.