XRP price traded near $2.95 on Oct. 2 as the token extended its rally for the seventh consecutive day. The token gained more than 3% in the session, touching a daily high near $2.99 before retreating.

XRP price action showed renewed strength despite broader market caution. Meanwhile, analyst Ali Martinez highlighted whale accumulation and on-chain stability, while others noted bullish chart structures as key drivers. Yet, the token does face challenges of possible volatility from Ripple’s leadership change, though ledger upgrades and new integrations offered a counterweight.

On-Chain Strength Reinforced by Ledger Upgrades

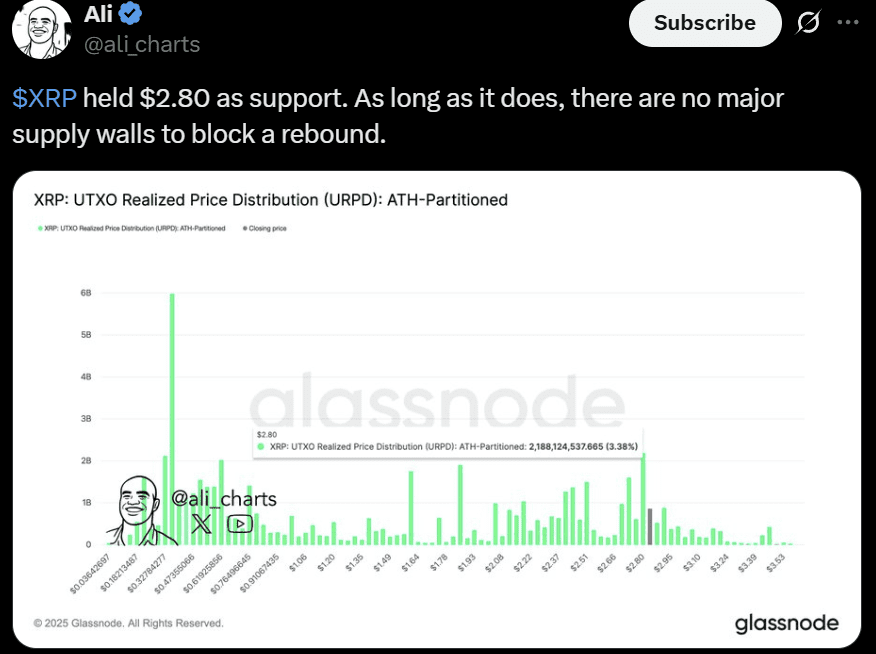

The focus shifted quickly to on-chain cues after XRP defended the $2.80 region. Analyst Ali noted that Glassnode’s URPD data showed a dense cluster of tokens last moved around that level, giving it structural support.

The analyst added that this zone marked the strongest defense point for holders in recent weeks. The reinforcement gave traders confidence that the downside remained limited.

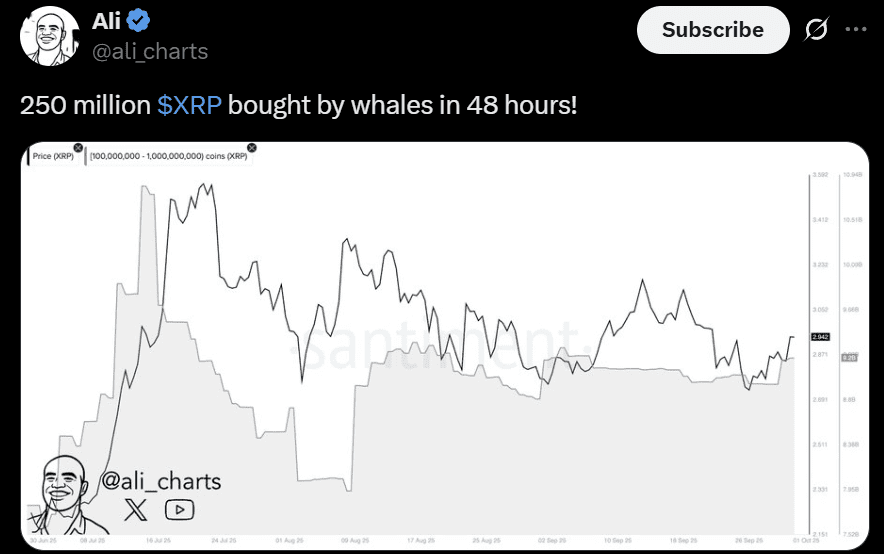

Additionally, Ali highlighted whale activity. He shared Santiment data that showed large wallets accumulated nearly 250 million XRP within two days.

The inflows signaled fresh demand from institutional-sized buyers while price held steady at support. Such aggressive accumulation often served as a sign of conviction rather than speculation. Market watchers pointed to this data as evidence that XRP’s recent rebound had depth behind it.

Fundamentals also added weight to the on-chain signals. Ripple recently confirmed a leadership change, with CTO David Schwartz moving into a board role while engineering heads took over daily operations. The shift could create volatility, yet the project offset concerns with visible progress.

The XRP Ledger activated its Multi-Purpose Tokens upgrade, simplifying asset issuance and widening adoption use cases. New integrations offered further support, including U.S. settlements through i-Payout and Singapore’s FOMO Pay adopting RLUSD.

The combination of whale inflows, structural backing at $2.80, and ecosystem growth left analysts balancing volatility risks with clear bullish cues.

Analysts Weigh XRP’s Breakout Prospects

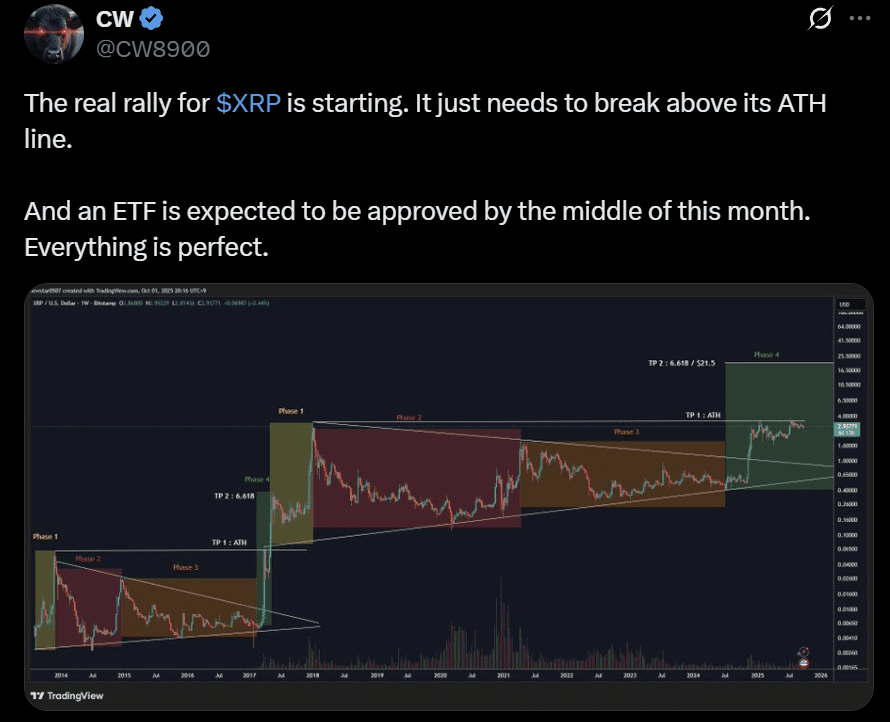

The on-chain stability left the focus on whether technicals could deliver follow-through. Analyst CW argued that the XRP USD pair had entered its strongest phase after years of consolidation. CW’s post divided the token’s history into four cycles and showed the current phase aligning with ETF speculation.

The analyst maintained that a break above the ATH line would open the door for a sustained rally, with targets extending toward long-term Fibonacci levels. The outlook leaned heavily on the ETF catalyst expected this month.

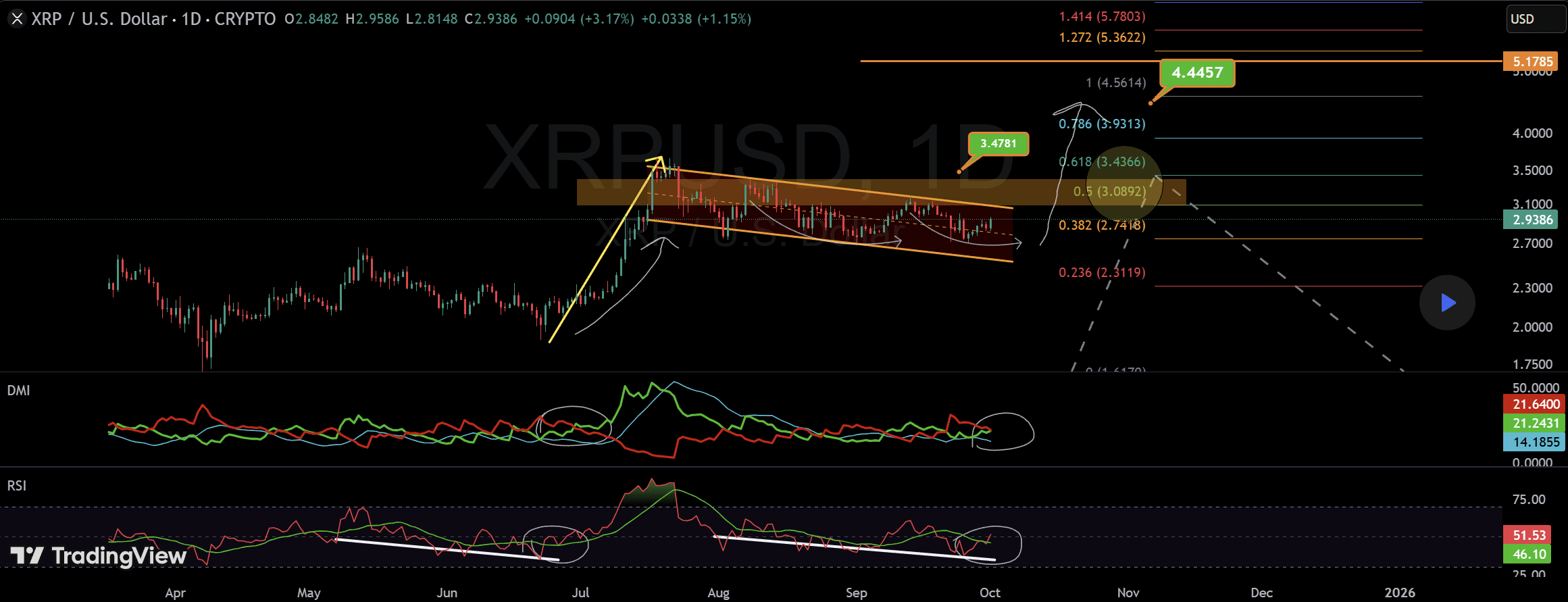

Analyst CryptoArsenal offered a more cautious reading. The market analyst noted XRP’s repeated falling wedge formations, each demanding confirmation through a breakout.

Arsenal’s latest chart showed price pressing against resistance near the upper boundary, yet still short of a clear move. He warned that a failure to breach could trap momentum again, leaving bulls vulnerable to fading support.

Alex Clay added another layer, flagging a completed pennant formation. He argued that the structure set up a push toward $4, provided momentum continued. The view placed weight on continuation patterns, marking XRP price’s past surges during renewed accumulation.

PersianBlockchain added further support, citing hidden bullish divergence on the RSI and a recurring DMI pattern.

The analyst framed the consolidation as a flag and projected upside continuation if the divergence translated into strength. His analysis aligned with the broader calls for a breakout, but rooted the optimism in indicator behavior rather than external catalysts.

Together, the four outlooks framed XRP’s immediate test as decisive.