Zebec Network’s token, ZBCN, traded near $0.0046 on Oct. 7 after dropping nearly 7% over the day. The token’s movement was surprising, since ZBCN was recently listed on Biconomy.com. This expanded access but failed to uplift the token’s price action.

Despite the pullback, ZBCN found support from analysts, such as pseudonymous trader Mood God. Moreover, on-chain data pointed to large wallet accumulations during the week, hinting at quiet institutional positioning.

Institutional Signals Build Around ZBCN Listing

The Biconomy listing gave Zebec fresh visibility in the spot market, pairing ZBCN with USDT for the first time. The exchange described Zebec as a decentralized infrastructure for real-world value transfers and noted that it had secured $35 million from backers including Circle, Coinbase, and Solana Ventures.

The move expanded Zebec’s exchange presence but did not trigger a major retail rush. Instead, trading volumes reflected steady participation from larger holders positioning quietly through limit orders.

That pattern aligned with on-chain readings highlighted by Summit Horizon’s X post. The firm’s analysts noted heavy 7–8 figure accumulations across multiple addresses, identifying them as institutional wallets rather than retail clusters.

Their report added that staking and token burns had already tightened the circulating supply, helping reinforce price stability during the pullback. These signals suggested that high-value participants viewed the recent dip as an opportunity to build exposure rather than exit.

The broader context also showed Zebec’s fundamentals gaining traction. Its real-time payroll and settlement framework continued scaling through new partnerships, including corporate and educational programs. That backdrop and regulatory alignment under frameworks like the EU’s MiCA positioned Zebec for deeper institutional adoption.

The data suggests that ZBCN price’s near-term direction now depends on whether these institutional inflows sustain through the next consolidation phase.

Analysts Eye Structural Support as Token Tests Resistance

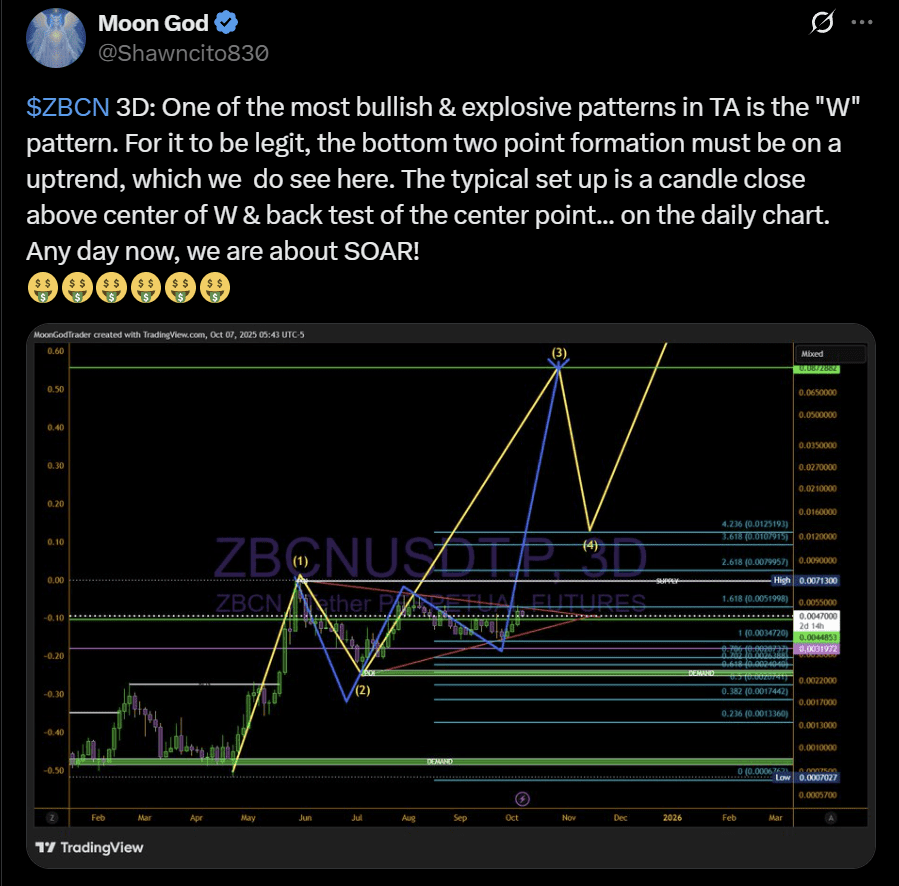

Technical observers, including Moon God, identified a broad W-pattern developing on higher timeframes, calling it one of the most bullish setups in classical analysis.

The analyst’s projection placed the next impulse above $0.007, provided that the price closed decisively above the midline of the pattern. Moon God’s post described the recent accumulation phase as the final base-building stage before a potential surge toward new local highs.

The analysis echoed earlier institutional cues highlighted by Summit Horizon, where accumulations suggested confidence in a long-term uptrend rather than short-term speculation.

Analyst sentiment around the ZBCN USD pair turned cautiously optimistic following its consolidation near $0.0046. The Zebec Network token’s rejection came near a multi-week descending trendline resistance that has previously bothered the bulls at least twice.

Yet, the Zebec Network token price remained above its 20-day and 50-day EMAs, confirming that buyers maintained control despite a temporary setback.

The RSI reading near 56 showed momentum cooling after a strong advance. This hints at a brief consolidation before another directional move. Though there were lower than May highs, market volumes continued to favor gradual accumulation rather than distribution.

Structurally, maintaining support near $0.0035 remains critical for sustaining bullish bias. Flipping the immediate resistance near $0.0054 would target the resistance near $0.00622. Failure to defend the lower range, however, could invite corrective pressure toward previous demand clusters near $0.0042 and $0.0035.

Overall, ZBCN’s setup reflected a balanced but constructive structure supported by steady accumulation and improving liquidity depth.

Is Dogecoin reaching $10 soon? Read here to find out