Community posts today highlighted ZebecNET, the connectivity initiative Zebec is building with World Mobile. They referenced the project’s phased rollout and framed it as part of Zebec’s broader push on real-time finance. These mentions repeated details from prior materials rather than revealing new actions.

Additionally, posters pointed to earlier descriptions of how ZebecNET aims to pair mobile access with streaming payments. They emphasized the planned beta timelines and market scope already disclosed by the partners. The references served as context for newcomers following the brand after recent conference coverage.

Moreover, several accounts linked back to official write-ups to clarify what ZebecNET includes and what remains pending. They underlined that today’s items were recaps and not fresh announcements from Zebec or World Mobile. The core information matched previously published posts.

Card program references return in user posts

Community members also resurfaced Zebec’s card messaging, including the Silver and Black products. They reiterated claims about global acceptance and wallet compatibility that Zebec has described on its site and past blogs. The posts did not add new product specs or release steps.

Furthermore, some threads pointed to the card program’s role in Zebec’s payments stack rather than pricing or token moves. They reused earlier images and one-liners from brand pages to explain how the cards fit payroll and spending. The framing stayed informational and avoided new commitments.

In parallel, the dedicated card handle remained a reference point for historical materials. Users cited it to show continuity of messaging, not to signal a change in status today. No new post from that handle introduced a feature or date.

At the same time, conference-week clips continued to circulate and draw attention to Zebec’s payments and stablecoin discussions. These videos appeared on media and creator channels rather than Zebec’s newsroom. They provided context but did not change the company’s disclosed roadmap.

Therefore, the net new information today was limited to community curation. Readers encountered summaries of ZebecNET and card features, anchored to earlier partner blogs and product pages, with no additional commitments from Zebec.

An on X, The_ZBCN_Enthusiast (@All_In_On_Zbcn), asserted today that “institutional whales” have accelerated ZBCN accumulation over the past two to three weeks. The post highlights “today alone,” citing a single buyer allegedly purchasing $3.8 million worth of tokens. It frames the activity as the largest recent wave of large-holder inflows and links the narrative to growing interest in additional exchange listings.

The author supports the claim with a collage of transaction tables that appear to show address-level transfers and notations of counterparties. However, the post does not specify the underlying explorer links, timestamps for each transaction line, or the methodology used to classify the buyer as institutional. Therefore, while the screenshots suggest size and repetition, the evidence remains third-party and requires independent on-chain verification to confirm amounts, timing, and actor types.

Additionally, the post was last edited at 11:00 AM on Oct 9, 2025, and displayed 985 views at capture. It tags Zebec’s official handle and a community figure to amplify reach, yet it stops short of naming venues, providing wallet clusters, or detailing routes through market makers or OTC desks. As a result, the item functions as community commentary rather than an official Zebec disclosure or a confirmed market structure report.

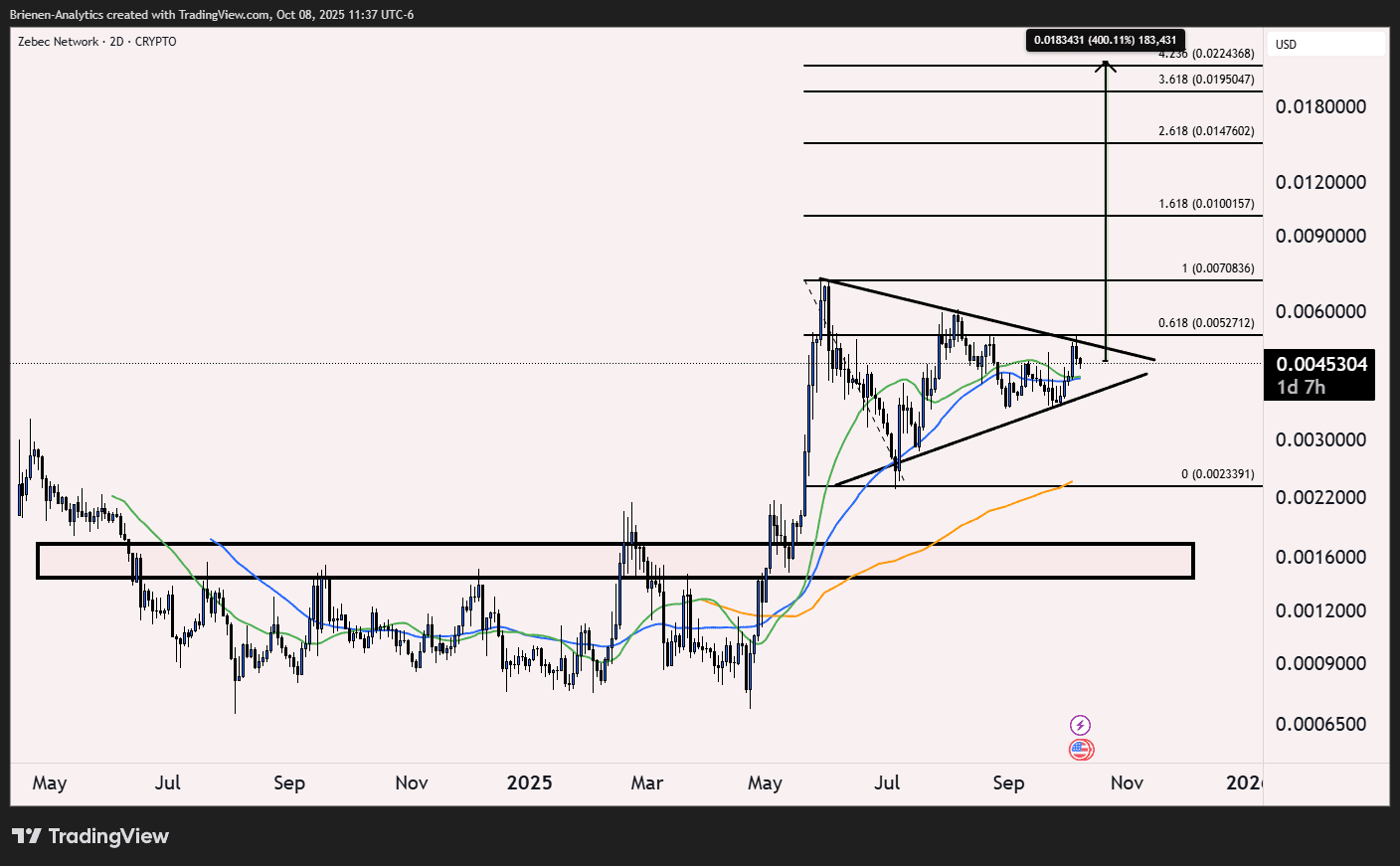

Analyst flags ZBCN “clean flag” with Fibonacci targets

CryptoCharged published a two-day ZBCN/USD chart showing consolidation inside a contracting flag beneath May’s impulse high. The chart marks converging trendlines and short- and medium-term moving averages sloping upward, while price sits near 0.00453. The analyst frames the structure as a continuation setup that has held above the prior “deep-value” accumulation zone from early 2025.

Using the flag’s range as the Fibonacci anchor, the overlay plots successive extensions at 1.618 (~0.01002), 2.618 (~0.01476), 3.618 (~0.01950), and 4.236 (~0.02244). The graphic highlights a measured move to ~0.01834, labeled “~400%,” if momentum resolves higher and follows typical extension behavior. The nearby retracement marker at 0.618 (~0.00527) aligns with the chart’s upper trendline, indicating a first validation area on any breakout and hold.

However, the analysis also implies clear invalidation risk. If price loses the rising lower trendline, the pattern would fail and shift focus back to former support around ~0.0030–0.0033 and, further down, the boxed accumulation band near ~0.0016–0.0019. Therefore, the technical read emphasizes confirmation: a strong close through the pattern’s ceiling, acceptance above ~0.00527, and sustained positioning over the short- and medium-term moving averages would support the continuation case, while a breakdown would negate it.